HOW I PAID TAXES IN GERMANY WITHOUT UNDERSTANDING THE TAX SYSTEM

If you don’t know the German tax system and would like to delegate the tax accounting, this article might be useful for you

In this article I would like to tell my personal story. First of all I’ll reveal a secret – only in 2017, eight years after I launched my company, I seriously started to learn and understand the German tax system. From the launch in 2008 until 2016 I could hardly distinguish income tax from sales tax.

In April 2009 I decided to move from Bremen to Berlin. In Bremen I registrated my first one man company "Interkulturelles Training und Management". In a search of a tax advisor I called a number which one friendly businessman gave me.

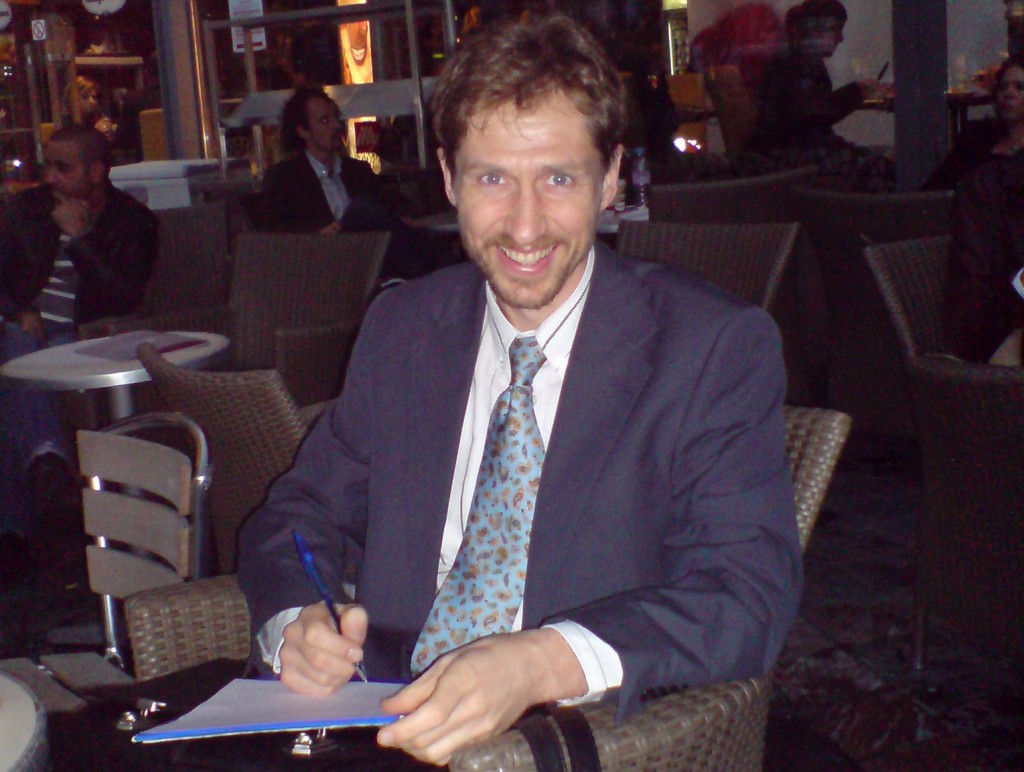

The name of a tax advisor was K.* and he invited me to his office. I brought all my accounting records and all formalities were done really quickly. That was awesome! It seemed that I had a good luck with a xhoice of tax advisor. We began a friendly conversation. I remember asking him a few questions about the basic principles of my taxation.

To be honest the German tax system wasn't really interesting to me. I asked these questions more as a politeness in order to "fill a gap". The tax consultant explained everything to me in a simple and friendly manner. It sounded like conversation between two good friends. His explanations seemed so easy to understand that I didn’t take any notes. However, all the material was too new and abstract for me. When I arrived home, most of the explanations were forgotten again.

A week later, when I was abroad, I decided to answer one of his questions by phone, not by email. After the details of the business had been clarified, I informed the tax consultant that I was in Turkey right now. Since we were both interested in Sufism, we talked about Turkish Sufi masters for another hour.

In the end of that month I got his invoice and couldn’t believe my eyes – the tax consultant charged me for the two talks, for this “friendly conversation”! Besides I had to pay him a nice sum for additional full two hours of his work.

That was really a shock! I changed this bandit as soon as possible.

I found another tax consultant over a friend. The new tax consultant asked me how many invoices I issue per quarter. Then he suggested a all-inclusive sum: I pay a fixed sum for each quarter and he makes the advance tax payments and the annual report. I immediately liked the idea of the fixed sum. I told him that we would try to work together for a year. After all, I worked with this guy for the next few years.

The lessons I learned: how to choose a fair tax advisor

- If you are looking for a tax consultant, consult 2-4 professionals

- As candidates, choose those who work as tax consultants and accept bank transfer (no cash payment!)

- Compare their charges and try to reach the fixed sum and all-inclusive deals.

A tax adviser could tell you that all-inclusive deals are difficult to manage because the number of invoices can vary. Say that within the first year you plan to issue a maximum of so many (say 1-5 invoices) in an average month. So try to reach a fixed sum agreement at least for the first year. After that, a lot of things will clear up on their own.

- If you need tax advice in the meantime, always clarify in advance whether you will not be billed for the interview

- Make as few calls as possible to your tax advisor. Most questions should be answered by email. This gives you full control over your business communication.

Your tax advisor may not like to run all the communication via email because some of the questions “can be answered very quickly by phone”. That may be true. But remember that written communication gives you a full overview and control of what was said, answered and promised. Phone calls can be more easily misunderstood and some agreements can be forgotten or ignored.

If you follow advices above, you don’t need to worry about the German tax system.

2018-07.11.23 ©️ Yarve (Jaroslav Plotnikov) All articles.